Rabbit Finance

Rabbit Finance - Leverage Farming Protocol for Big Profits

Rabbit Finance is a Binance Smart Chain (BSC) based agricultural product protocol released by Rabbit Finance Lab. It supports users participating in liquidity farming through excess borrowing plus leverage to earn more income.

When users have insufficient funds but want to participate in DeFi's liquidity farm, Rabbit Finance can provide up to 10X the leverage to help users earn maximum revenue per unit of time, and at the same time provide loan pool for users who prefer stable returns. to make a profit.

Strength & Vision

Strength & Vision

Rabbit Finance fully leverages and adopts the advantages of projects in the market, using over-exploited agricultural products with the advantages of Alpaca Finance and Badger Finance, creatively incorporating an algorithm-stable coin mechanism to empower the RABBIT token. Across the economic ecology of Rabbit Finance, the RABBIT token, endowed with more application scenarios, represents not only the governance rights and interests of the leveraged farming protocol, but also the token rights and shareholder interests of the RUSD algorithm stable coin. Whenever the RUSD experiences inflation, members who pledge R tokens to the meeting room will distribute additional RUSD as dividends to share the benefits of ecological growth.

Rabbit Finance believes that the leveraged yield farming platform will be the next killer app in the Defi field after a decentralized exchange and lending platform. It is also believed that the algorithm stable coin is the last Holy Grail in the Defi field. They are and will be the most important infrastructure in the world of Defi.

Rabbit Finance's vision is to become the Federal Reserve of the Defi world, based on the principles of equal opportunity and commercial sustainability, and to provide appropriate and cost effective financial services for people of all social walks of life and groups who need financial services. Rabbit Finance is not a simple leveraged farming platform or an algorithmically stable coin system. It will be a decentralized and inclusive financial services infrastructure with sustainable hematopoiesis capabilities and based on blockchain technology. Compared to the same role as the Fed, what Rabbit Finance expects goes far beyond the role of the Fed in the world economy.

Strategy

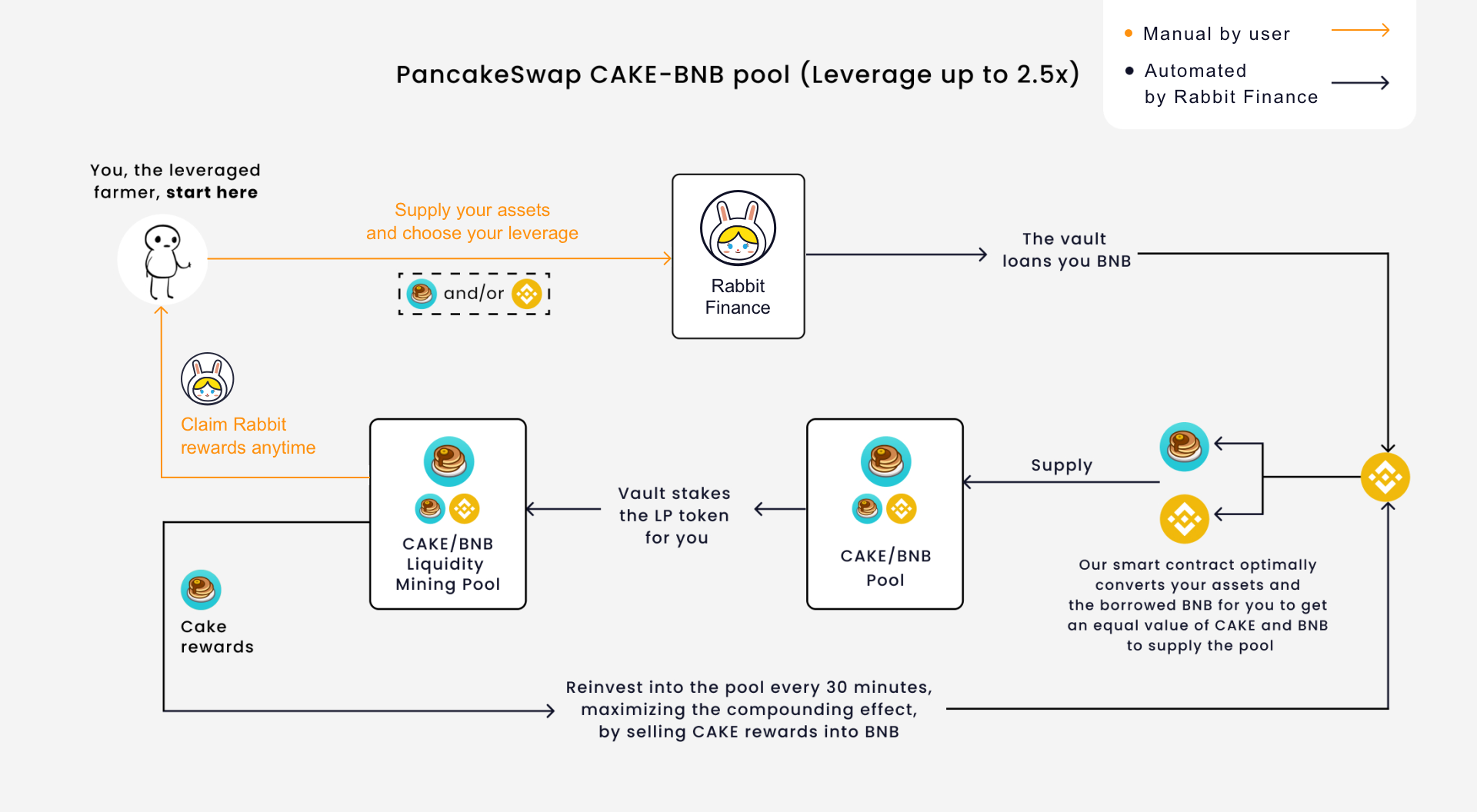

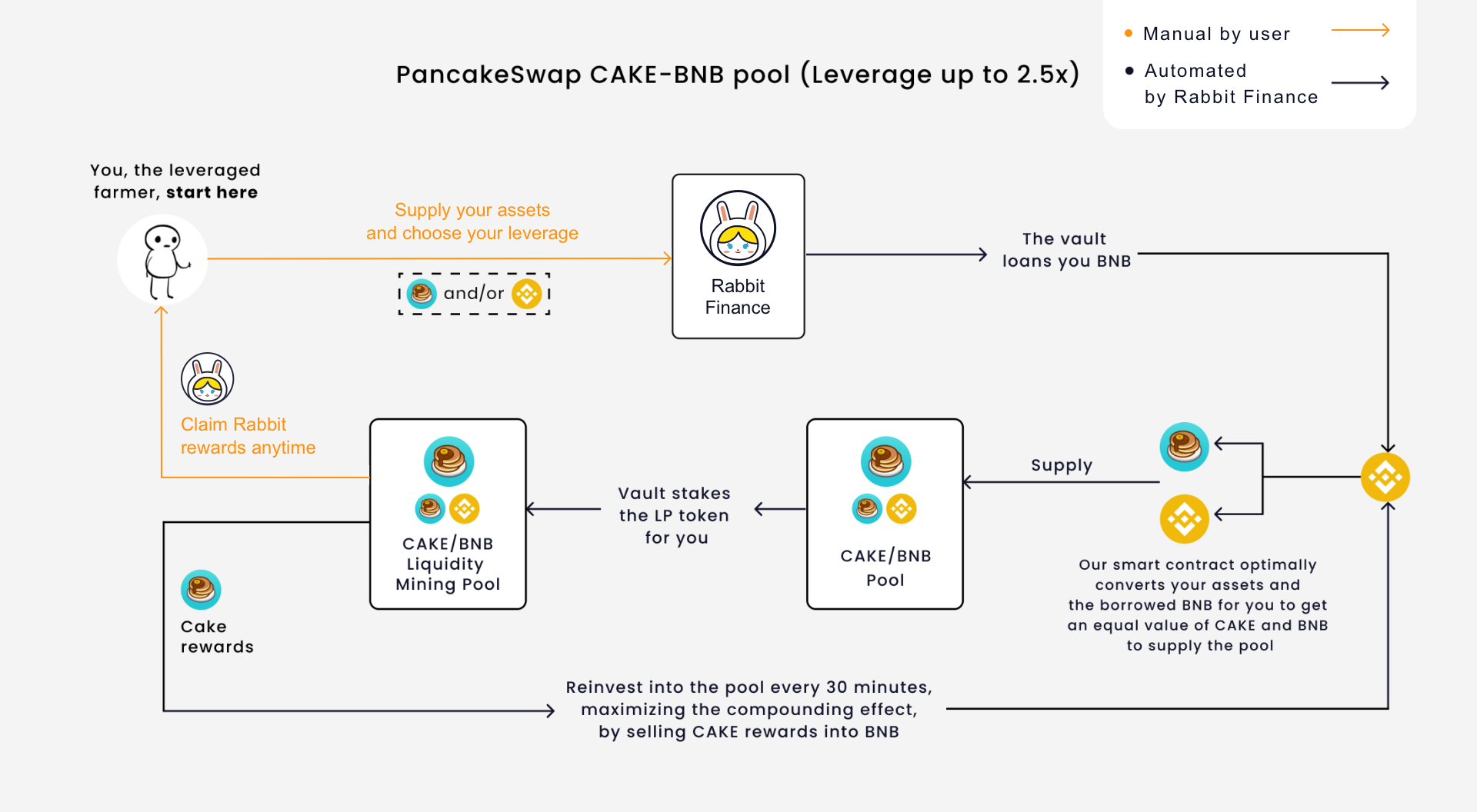

Rabbit Finance employs successful strategies to achieve the highest possible yield for our farmers. We also want to make sure our users get the best experience when interacting with our platform. That's why we've simplified the leveraged farming process by automating a lot behind the scenes.

Some of our key features to improve usability are:

- Flexible deposit options: our vault optimally converts your saved assets and your borrowed BNB or BUSD to get an equal share of value to supply the farm liquidity pool. So for example, for a CAKE / BNB pool, you can deposit any amount of CAKE and / or BNB to start farming without having to do the conversion yourself.

- Auto-bet: our code bets LP tokens for you on the selected platform (PancakeSwap, etc.) automatically, so you can start earning prizes right away.

- Sustainable compounding: bounty hunters monitor the amount of bounty earned in each batch and help all farmers reinvest them. Our smart contracts can sell your prizes (CAKE, etc.), turn them into LP tokens for the batch you grow, and incorporate them into your farming principles so you can get the most out of your APY.

- Claim the RABBIT prize any time: by opening a leveraged farm position, you will get a bonus prize which can be claimed at any time on the betting page.

How to Participate?

1. As a user, you can participate in Rabbit Finance in four different ways:

- Lenders: Rabbit Finance allows you to earn income on your basic assets by depositing them in our vaults. These assets will then be offered to yield farmers to increase their position.

- Farmers: As a farmer, you can get higher yields by opening a leveraged position with Rabbit Finance. Of course, this comes with a bigger risk: liquidation, variable losses, etc.

- Liquidators: Monitor ponds for underwater positions and liquidate them when they become too risky.

- Bounty Hunter: Prize hunter in pool and execute reinvestment, 30% of bounty pool is used as buyback fund to promote token value. For this service, he takes 0.4% of the bounty pool as a reward, the remaining 69.6% will be converted into pool LP and promises again to get a combined return.

At launch, we will support the two basic assets of BNB and BUSD, and integrate our leveraged farm with PancakeSwap.

2. In the example below, we show how each participant works together in our ecosystem:

- Cora, the lender deposits his BNB in our safe; the assets are available for borrowing by yield farmers; he earns interest for providing this liquidity.

- Dunn, the yield farmer wants to open a leveraged yield farm position in the BTC / BNB pair; he borrowed BNB from the vault and enjoyed higher yielding agricultural produce.

- Rabbit Finance smart contracts handle all the behind the scenes mechanisms optimally transferring assets to the right ratio, providing liquidity to the pool, and staking LP for Pancake Rewards

- Gary, the liquidator monitors the health of each leveraged position, and when it goes beyond the prescribed parameters, he helps to liquidate the positions, making sure the lender doesn't seem to lose his capital. For this service, he takes a 5% reward from liquidated positions.

- Bounty hunter James keeps track of the amount of bounty earned in each batch and helps reinvest it, combining returns for all farmers. For this service, he takes 0.4% of the prize pool as a reward. 30% as buyback funds, which will be used for RABBIT buyback and deflation. The remaining 69.6% will be converted into LP from the pool and guaranteed again to get multiple returns.

For the specific strategies of each farm group, please see the diagram below.

Take CAKE-BNB as an example to illustrate

Liquidation

If your debt ratio exceeds the threshold (Kill Factor), your position will be liquidated.

The value you receive back after liquidation will depend on the Kill Factor. Please refer to the table below for an estimate

Kill Factor - Pools Liquidation Bounty The estimate of the value returned to the farmer

80% CAKE-BNB 5% ~ 19% of total debt

83.3% BTCB-BNB 5% ~ 16% of total debt

ETH-BNB

BNB-BUSD

BNB-USDT

USDT-BUSD

96% DAI - BUSD 5% ~ 3.5% of total debt

USDC-BUSD

Example:

Dunn opened a 2x leveraged yield farm position in the CAKE-BNB pool

- He supplies 10 BNB

- Our vault lends its 10 BNB

- We then optimally convert BNB to CAKE and obtain an LP token for it

Currently, the position is ~ 20 BNB (in fact, it will be slightly lower due to the price impact of exchanges and trading fees)

- Debt ratio ~ 50%

Some time later…

The price of BNB has appreciated significantly causing Dunn's position to be less valuable in the BNB term. This is because the LP pool will try to maintain the same value of the token pair, causing it to have more CAKE and less BNB in its position.

Unfortunately, BNB's price continues to appreciate so that its debt ratio has reached 80% (Kill Factor), and a liquidation bot calls a smart contract to close its position.

- Currently, the position value is roughly ~ 12.5 BNB

- 10 BNB will be used to repay the loan

- 0.125 BNB (5% of the remaining 2.5 BNB) will be paid to the liquidator as a reward

- 2,375 BNB will be returned to the user

To make this example easy to understand, please note that this example ignores the impact of agricultural yields and trading costs on increasing the value of Dunn's position and making his position safer. It also ignores the interest rate on the loan which will increase the value of the debt, making the debt ratio higher.

Parameter Global

Parameter - Value - Description

Minimum debt size BNB - 2 BNB

The minimum amount in BNB a user can borrow to open a leveraged position

Minimum debt size is BUSD - 400 BUSD

The minimum amount in BUSD that a user can borrow to open a leveraged position

Minimum debt size USDT - 400 USDT

The minimum amount in USDT a user can borrow to open a leveraged position

Minimum debt size DAI - 400 DAI

The minimum amount in DAI that a user can borrow to open a leveraged position

The minimum debt size is USDC - 400 USDC

The minimum amount in USDC a user can borrow to open a leveraged position

CAKE minimum debt size - 30 CAKE

The minimum amount in CAKE a user can borrow to open a leveraged position

The minimum debt size of BTCB - 0.01BTCB

The minimum amount in BTCB a user can borrow to open a leveraged position

The minimum debt size of ETH - 0.2ETH

The minimum amount in ETH a user can borrow to open a leveraged position

Recommendation intake rate - 20%

Percentage of loan interest included in the proposal group. Half for repurchase and burning of RABBITS

Liquidation bonus - 5%

Call the clearing function to delete an order

Return investment reward - 0.4%

One who performs the re-investment function to maximize user profit

Interest = m * utilization + b

Parameter Pool

The table below describes the specific parameters for each batch:

- Employment factor: The maximum debt ratio when opening a position.

- Killer factor: Maximum debt ratio, beyond which anyone can liquidate a position.

Platform - Pool - Work factor (leverage) - Killer factor

- Pancake – CAKE-BNB: 60.00%(2.5x)- 80.00%

- pancake – BTCB-wBNB: 66.67%(3.0x)- 83.33%

- pancake – ETH-wBNB: 66.67%(3.0x)- 83.33%

- pancake – BNB-BUSD: 66.67%(3.0x)- 83.33%

- pancake – BNB-USDT: 66.67%(3.0x) – 83.33%

- pancake – BUSD-USDT: 90.00%(10x)- 96.00%

- pancake – BUSD-DAI: 90.00% (10x) – 96.00%

- pancake – BUSD-USDC: 90.00%(10x)- 96.00%

Employment factors and stopping factors can be adjusted from time to time to balance risk and reward for all users on the Finance platform. In addition, while the core developer will set initial values, the Governance community will be able to vote on changing these parameters in the future.

Pool address

- Pancake: CAKE-wBNB

- Pancake:BTCB-wBNB

- Pancake : ETH- wBNB

- Pancake:BNB- BUSD

- Pancake : BNB -USDT

- Pancakes : USDT -BUSD

- Pancake: DAI -BUSD

- Pancakes : USDC -BUSD

What are RABBIT tokens?

The RABBIT token is Rabbit Finance's governance token. This will also capture the economic benefits of the protocol. There will be a maximum of 200 million R tokens.

What is the RABBIT token used for?

1. Protocol Governance

We will soon be launching a governance vault that will allow community members to stake their RABBIT tokens. RABBIT Stakers will receive xRABBIT where 1 xRABBIT = 1 vote, enabling them to decide on major governance decisions. In the initial phase, governance decisions will be made on the Snapshot.

2. Capture the Economic Benefits of the Platform

Rabbit Finance Protocol users (depositors and borrowers, i.e. lenders and farmers) will be given RABBIT tokens for their deposit and loan behavior. The Rabbit Finance platform will prepare a buyback fund with its income, which will be used for deflation and appreciation of the RABBIT token. When the income is reinvested, 30% of it is used for the RABBIT buyback fund. 20% of depositors' interest income is used as market development funds. All of this will contribute to increased demand and growth in the value of RABBIT.

3. Get Economic Benefits from RUSD, RBTC, RBNB, etc.

The RABBIT token is a shareholder rights token of the algorithm stable coins RUSD, RBTC, RBNB, etc. Whenever RUSD etc is experiencing inflation, members who pledge RABBIT tokens to the meeting room will distribute additional RUSD as dividends to share the benefits of ecological growth. For more details, please pay attention to our follow-up announcement.

Community collection release program

The RABBIT token will be released over a two year period with a rotting emission schedule, and will be distributed evenly across the ecosystem as a community reward.

In total, there will be 159,500,000 RABBITS. In order to incentivize early adopters, there will be a bonus period for the first weeks. Below is our planned block reward schedule. Based on this, the profile of the circulating RABBIT supply can be plotted.

Pools Allocation

Below is the allocation of points for each pool that determines the prizes distributed. Bonus period

Open the deposit vault & pancakeswap liquidity pool, emission rate: 42 RABBIT / block. It lasts about a week.

Pools - RABBIT / block

● Deposit Collection : ibBNB - 2.52

● Deposit Collection : ibBUSD - 2.52

● Deposit Collection : ibUSDT - 2.52

● Deposit Collection : ibUSDC - 2.52

● Deposit Collection : ibDAI - 2.52

● Deposit Collection : ibBTCB - 2.52

● Deposit Collection : ibETH - 2.52

● Deposit Collection : ibCAKE - 2.52

● Pancakeswap RABBIT-BNB LP - 21.84

Officially Launched

When leveraged agriculture was officially launched, emission level: 20 RABBIT / block (take this as an example).

Pools - RABBIT / block

● Deposit Collection : ibBNB - 0.625

● Deposit Collection : ibBUSD - 0.625

● Deposit Collection : ibUSDT - 0.625

● Deposit Collection : ibUSDC - 0.625

● Deposit Collection : ibDAI - 0.625

● Deposit Collection : ibBTCB - 0.625

● Kumpulan Deposit : ibETH – 0,625

● Kumpulan Deposit : ibCAKE – 0,625

● Pancakeswap RABBIT-BNB LP – 8.0

● Pancakeswap USDT-BUSD LP – 0,875

● Pancakeswap DAI-BUSD LP – 0,875

● Pancakeswap USDC-BUSD LP – 0,875

● Pancakeswap USDT-BNB LP – 0,875

● Pancakeswap CAKE-BNB LP – 0,875

● Pancakeswap BUSD-BNB LP – 0,875

● Pancakeswap ETH-BNB LP – 0,875

● Pancakeswap BTCB-BNB LP – 0,875

Conclude

Rabbit Finance fully utilizes and utilizes projects in the market, utilizing excessively leveraged agricultural products with the benefits of Alpaca Finance and Badger Finance, creatively incorporating an algorithmic stablecoin mechanism to empower RABBIT tokens. Across the economic ecology of Rabbit Finance, the RABBIT token, endowed with a large number of application scenarios, represents not only the right to manage and the interests of the leveraged agricultural protocol, but also the rights and shareholder interests of the RUSD stablecoin algorithm.

Rabbit Finance can provide up to 10x leverage to help users maximize revenue per unit of time, while providing a loan pool for users who prefer stable income to generate profits.

Join our community

Related links

Rabbit Finance website: http://rabbitfinance.io/

Github: https://github.com/RabbitFinanceProtocol

Twitter: https://twitter.com/FinanceRabbit

Telegram: https: // t .me / RabbitFinanceEN

Discord: https://discord.gg/tWdtmzXS

Contract Information: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

Audit report: https://app.gitbook.com/@rabbitfinance/ s / homepage / resources / audit-report

Username: LautaromartinesLink: https://bitcointalk.org/index.php?action=profile;u=3122437

Join our community

Rabbit Finance website: http://rabbitfinance.io/

Github: https://github.com/RabbitFinanceProtocol

Twitter: https://twitter.com/FinanceRabbit

Telegram: https: // t .me / RabbitFinanceEN

Discord: https://discord.gg/tWdtmzXS

Contract Information: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

Audit report: https://app.gitbook.com/@rabbitfinance/ s / homepage / resources / audit-report

Komentar

Posting Komentar